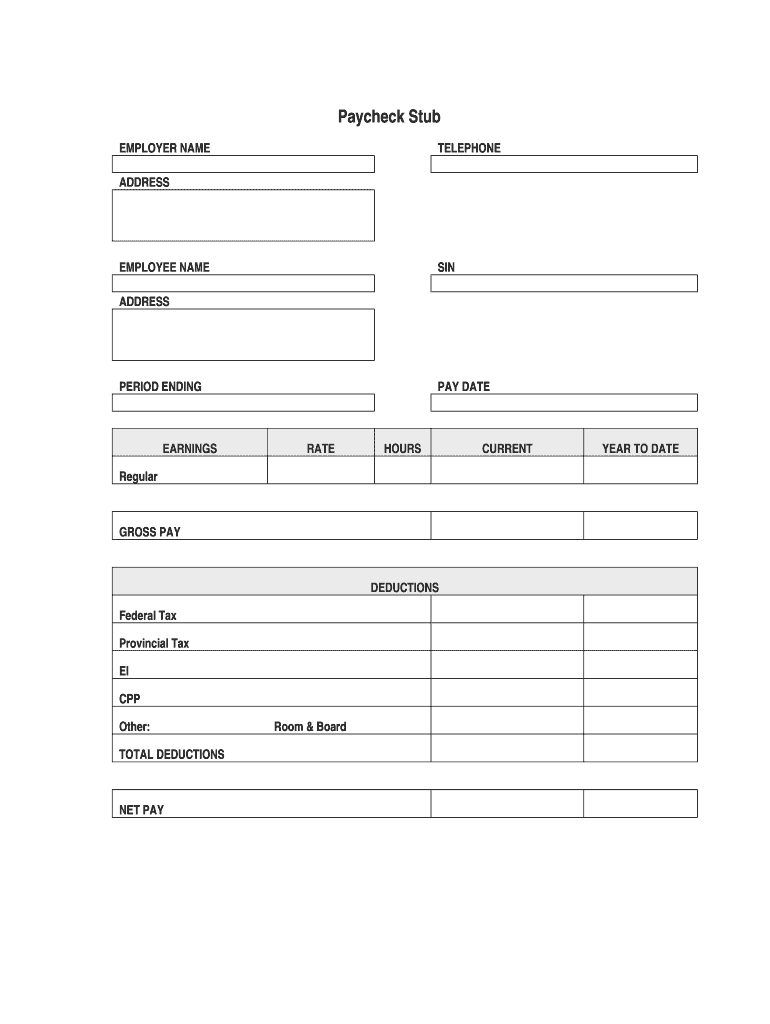

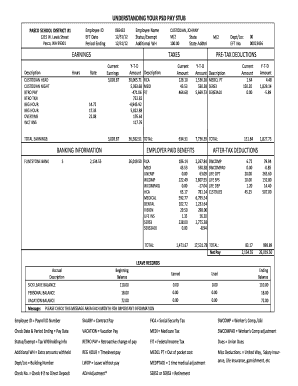

Who needs a Paycheck Stub Blank?

A Paycheck Stub Blank is supposed to be used by an employer in order to notify their employee that payment has been made for their services. Both an employer and an employee can benefit from delivering a Paycheck Stub. On the one hand, employees get to know all the important information on their wages and deductions. On the other hand — a Paycheck Stub assures an employer that the payment is correct.

What is the Blank Pay Stub for?

The fillable blank payroll check template is designed to calculate the salary of employees, e.i. It indicates the earnings depending on the number of hours worked, the taxes applied, and the total net payment.

Is the Paycheck Stub accompanied by other forms?

An employer does not have to supplement the Pay Stub with any other forms or documents.

When is the Blank Paycheck Stub PDF due?

The Paycheck Stubs are given to employees on their paydays. Depending on the job they are engaged in, the pay can due once a month on a set date, twice a month or once a week.

How do I fill out the fillable paycheck stub template?

To be properly recorded, the Stub must bear information about the following:

- Employer (name, telephone, address)

- Employee (name, SIN, address)

- Period of labor performance

- Pay date

- Salary (earnings, rate, hours, current, year to date)

- Gross pay

- Deductions

- Net pay

Where do I send Paycheck Stub Blank?

The Paycheck Stubs are to be sent to employees for their consideration and personal records.